Dollar Cost Averaging

If market volatility has caused you to transfer your money into GICs or cash, you may want to ask yourself if you are still on track to meeting your personal goals. Whether it’s saving for retirement, a home or a child’s education, keeping money in a lower-earning investment option may not give you the growth you need.

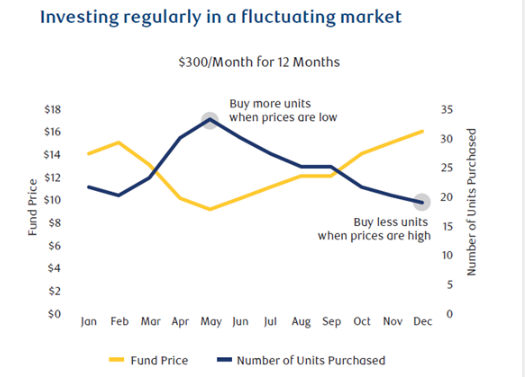

Our goal is to find the most effective way to put your money to work and build up your wealth. There is a tried and tested strategy for investing called Dollar Cost Averaging (DCA), which smooths out the costs of investing by regularly buying over time. One way to do this is investing a lump sum of money into a temporary safe haven investment holding (ex: money market) to avoid market volatility and then systematically switch portions of that into your target investment(s) over a regular period of time. This helps you avoid the risk of market timing.

Another way the DCA strategy can be achieved is by Pre-Authorized Contributions (PACs). PACs allows you to make withdrawals directly from a saving or chequing account and then deposit the amount to a particular investment(s) on a regular basis, such as monthly or bi-weekly. This will allow your savings to grow automatically.

Dollar Cost Averaging is right for all markets

- In a falling market: DCA can let you purchase more securities

- In a rising market: DCA can protect you from paying too much

- In a flat market: DCA ensures you always stay invest

Benefits of Pre-Authorized Contributions:

- Helps you stick to your plan

- Takes advantage of compound growth

- Eliminates the guesswork of when to invest

- Helps you avoid the rush of yearly RRSP contributions

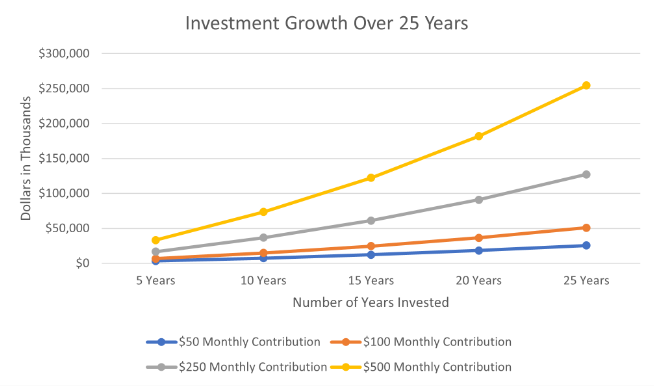

Double your PAC

Even small increases to a PAC can help you reach your long-term goals faster. The chart below illustrates the impact of doubling your PAC on a monthly contribution overtime of $50 increased to $100, and $250 increased to $500.

Assumes a 4% annualized rate of return. Used only to illustrate the effects of compound growth rate and is not intended to reflect future values of any particular investment.

This investment strategy helps you minimize volatility and avoid the risk of market timing. It is not a one-day initiative but rather a continuous long-term activity. The earlier you start investing, the better you will be in the future. I look forward to discussing these with you in more detail and seeing how these strategies could assist you in achieving your goals.